We’d all hoped for a smoother entry into 2021. But after multiple snap lockdowns, uncertain times look likely to continue for some time.

So how do you give your customers the confidence to invest in energy-saving equipment right now?

We’ve come up with three powerful talking points to help you reignite conversations with your customers.

Talk point #1: Conserve capital and pay less for power

When businesses are more cautious with money, the financial benefits of getting solar equipment on a payment plan really shine through.

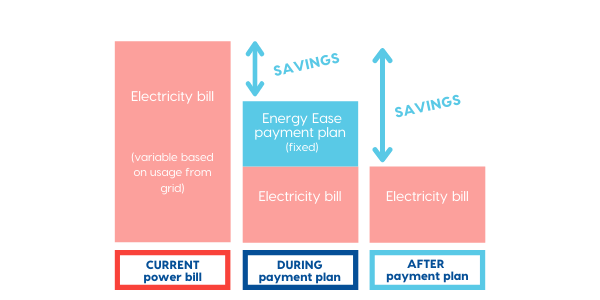

Many of your customers may not understand that on a payment plan, they can conserve capital and still get energy-saving equipment. On top of that, they will reduce their electricity overheads.

Here’s how you could break it down for them.

Getting energy-saving equipment on a payment plan means:

- The equipment gets installed without having to pay up front.

- Pay for energy-saving equipment in manageable monthly instalments over time (to help with cash flow).

- The new electricity bill is slashed because of the new energy-saving equipment.

- Typically the sum of the new lowered bill and the monthly payments is less than the original power bill.

For customers who are more visual, our graph below sums this up nicely.

Talk point #2: Discuss the differences between renting and owning equipment

A rental payment plan and a chattel mortgage are just two different ways to finance business equipment.

Help your customers understand that if they choose a rental payment plan, they’re renting from the financier (in this case, Smart Ease) for the term outlined in the agreement. At the end of the term, a small amount is paid to purchase the goods from the financier and ownership is transferred from the financier to the business.

If your customer chooses a chattel mortgage, their business owns the system and they pay off the loan – just as a house mortgage is a loan to pay a house off.

Let your customers know that each arrangement may have different tax implications for their business, so they should talk it through with their tax advisor.

Talk point # 3: Forget the talk, just show them your proposal

When you include a payment plan in your proposals you remove the objection of “I can’t afford it”.

In smaller manageable chunks, the equipment cost is always going to be much less daunting for your customer. The pitch becomes, “you can either purchase the system for $80,000 or $1,195 per month over 7 years”.

What’s more, using the Smart Ease platform, you can take advantage of getting the application approved and signed while onsite with the customer.

Clear the way for your customer’s decision by having the information at hand, and paperwork mostly completed.